The FAFSA Is Changing -- Here's What You Need To Know

Significant changes to the FAFSA will affect millions of students paying for college. Here's what to expect and when.

Significant changes to the FAFSA will affect millions of students paying for college. Here's what to expect and when.

By Amanda Black,

Associate Director of Communication and Financial Literacy

Let's be honest. Few acronyms can strike more dread in the heart of a college student than FAFSA.

And now you've heard that major changes are coming down the pike.

Terrific.

Actually, the changes are not as onerous as you might think and will benefit students.

Even better, filing for the 2015-2016 academic year remains the same; the changes don't take effect until the following year.

So you can relax. There's plenty of time to understand what's going to be different.

Here are answers to some of the questions you might have.

FAFSA stands for Free Application for Federal Student Aid, and the application must be filled out every year by students interested in receiving financial aid. The data submitted on the FAFSA is used to determine the amount of grants, scholarships, work-study, and loans awarded to a student.

The information entered is also used to calculate a student's EFC. EFC stands for Expected Family Contribution and is used to determine a student's eligibility for federal student financial aid, and in some cases, institutional financial aid. Students are encouraged to complete the FAFSA annually, online at fafsa.ed.gov.

Traditionally, students complete the FAFSA as soon as possible once it is released in January by the Department of Education.

Two big changes to the FAFSA process were announced in September. These are:

Beginning next fall, students will be able to file a 2017-2018 FAFSA in October (of 2016). This is instead of having to wait until January of 2017 to do so. Filing your FAFSA in October (or at least having the option to do so) will be a permanent change to the FAFSA process.

The second change pertains to the data students will submit on the FAFSA. Traditionally, when completing the FAFSA, students submit tax information from the prior year. For example, students who completed the FAFSA for the current 2015-2016 school year used tax data from their 2014 tax return.

Beginning with the 2017-2018 FAFSA, students will enter income and tax information from an even earlier tax year. For the 2017-2018 FAFSA, students will use tax information from two years prior to the academic year they are applying for. This is called prior-prior year data. This means that filers will use 2015 tax data to apply for financial aid for the 2017-2018 academic year.

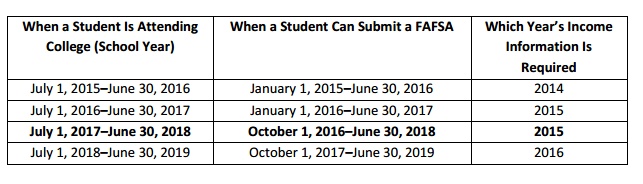

Below is a chart to clarify what income and tax data will be used for each academic year:

As confusing as this may appear, the actual act of submitting the information should be fairly painless. That's because when a student files online, most are able to use the IRS data retrieval tool. The IRS data retrieval tool allows a FAFSA filer to transfer their IRS tax return information from the IRS Web site directly into their FAFSA. This cuts down on the amount of time it takes to complete the application, as well as decreases room for error.

Even though these changes are approaching, students should note that the FAFSA process for the 2016-2017 academic year will be business as usual. (When dealing with a machine the size of the U.S. Department of Education, it's important to understand that change takes time.)

The FAFSA for the next academic year (2016-2017) will be available Jan. 1, 2016. Also, the usual prior year's tax and income data (for 2015) will be used. It's not until the following academic year – 2017-2018 – that the two big changes will apply.

These changes to the FAFSA will benefit filers in several ways.

First, since students will have the option to submit their FAFSAs earlier, they are able to position themselves to receive financial aid packages sooner. If an incoming freshman is trying to decide which school to attend, receiving aid packages sooner will allow him more time to make a decision and explore options. This opens the door to better planning since students (and parents) may end up with more information, earlier.

Second, the switch to using prior-prior year data also means that FAFSA filers will no longer need to estimate the figures on their applications, only to have to update the numbers later once they file their taxes. Since filers will be using tax data from two years prior, the information they need to submit will already be available.

(Often students would submit their FAFSAs in January – before they even filed their taxes – and estimate some of the information. Once they filed their taxes, they would then go back to their FAFSAs and update the estimated information with the actual tax data -a bothersome inconvenience for many.)

If you are attending school next year – during the 2016-2017 academic year – your FAFSA filing process will be the same as always. The 2016-2017 FAFSA will be available January 1 and you will use 2015 income tax information to complete it.

If you are attending school the following year – during the 2017-2018 academic year – your FAFSA filing process will be a bit different. You will be able to file the FAFSA as early as next October (2016). The 2017-2018 application will be the first FAFSA to require prior-prior year data. On this FAFSAA, students will again submit income tax data from 2015.

Looking ahead to the year after next – if you are attending school for the 2018-2019 academic year, you will use 2016 income tax information.

As you may have noticed, students will use income tax information from 2015 for two years in a row on their FAFSAs. Unfortunately, this does not mean that their financial aid package for two years in a row will definitely remain the same. Students will still need to submit data representing the total value of their current assets at the time they are completing the FAFSA.

For example, if you inherit a small farm or hit the lottery in October of 2017 – even though you are submitting 2015 tax data for the second time - you will need to report your good fortune on the FAFSA.

Remember, you won't know what financial aid – and potentially free money – is out there for you unless you file the FAFSA. The best way to do so is to file online at fafsa.ed.gov. Be sure to file every year, and always strive to use the most accurate information you have available.

If you have questions about the FAFSA or how to complete it, call 1-800-4-FED-AID (1-800-433-3243). If you have questions about your financial aid at Saint Leo University, please visit the Saint Leo University Financial Aid webpages or call Financial Aid Support toll-free at 1- 800-240-7658 to speak with a Financial Aid Liaison.

A Certified Educator in Personal Finance®, Amanda Black is passionate about promoting financial literacy and helping student loan borrowers responsibly manage their debt. When she is not at work, Amanda enjoys jogging, sharing a glass of wine with friends, and traveling with her husband. You can reach her in the Financial Aid Office at 800.240.7658 or Amanda.black@saintleo.edu.

A Certified Educator in Personal Finance®, Amanda Black is passionate about promoting financial literacy and helping student loan borrowers responsibly manage their debt. When she is not at work, Amanda enjoys jogging, sharing a glass of wine with friends, and traveling with her husband. You can reach her in the Financial Aid Office at 800.240.7658 or Amanda.black@saintleo.edu.

Other posts you may be interested in reading:

Beware Of Student Loan Repayment And Consolidation Scams!

Get Financially Fit: 10 Tips For Students

How To Afford College As An Adult

6 Tips For Mastering Student Loan Debt

Image credit: Ksenia Ragozina on Shutterstock.com